To keep your business in the black, Investopedia notes that you want to keep business debt at a debt-to-income ratio of 2.0 or less. This number represents your debt compared to your income.

If your debt is higher than this, or you feel like it’s overwhelming and harming your or your business’s well-being, Essential Home Office Supplies explains that it might be time to create and implement a debt reduction plan.

Consider Expanding Your Business

While it may seem counterproductive to expand your company when you’re in debt, it could be an opportunity to increase your revenue. Instead of borrowing money to cover expenses, consider taking out a loan to expand your business.

For instance, you could offer new products or services to increase your income and pay off any debt you have more quickly. Use the money you take out for marketing purposes or to invest in parts for your products.

Improve Your Business Skills

Take this time to sharpen your business skills so you can better manage your company. If time is an issue, consider an online school. You can enter a business program where you can learn about finance, business ethics, marketing, and finance.

Also look at ways to increase your productivity, such as using smart time management techniques. Reduce or omit those repetitive tasks that are time-consuming by automating processes like invoicing.

For example, you can use a free invoice template online to easily and quickly generate customized invoices from templates that are both professional looking and simple to download and send to your customers or clients.

Hire a Business Consultant

BizFluent points out that business consultants assess a company from every angle. They look at the type of business, the debt, recurring expenses, and other information to understand the company’s operations.

This individual uses their expertise to target areas of your business that may be lacking. A business consultant can also improve your marketing technique.

Decrease Your Expenses

While it’s always essential, it’s important now more than ever to reduce your expenses. This is especially the case if you’re not the one who typically handles your finances or ordering.

Analyze your expenses carefully. Are all those costs absolute needs, or can you trim some? For instance, maybe you have an employee or two who float rather than have specific jobs themselves.

Additionally, evaluate your vendor and insurance prices. Rather than just renewing with those individuals or companies, take this as a time to bargain shop.

You might be able to get more for your money elsewhere or at least reduce your expenses without harming the integrity of your products or services. It could also help to renegotiate the terms.

One option is to form a limited liability company (LLC) to reap the reward of tax advantages during tax season. This structure also gives you flexibility and limits your personal liability.

Research your state’s regulations before forming an LLC to remain compliant with the law. Fortunately, you can reduce the cost of this process by using a formation service.

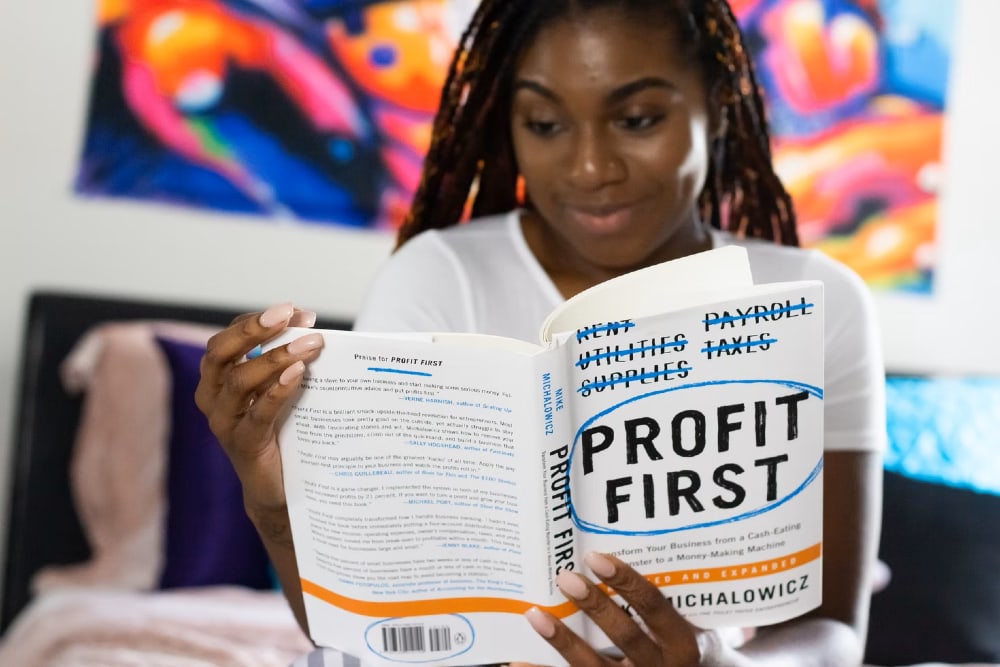

Learn to Budget

If you don’t already know how to budget, learn this skill. Generally, you should underestimate rather than overestimate how much revenue you bring in regularly.

You’ll then have more money to play with once all of your expenses are taken care of, and you won’t overspend. This is one time when you may want to hire a professional if you’re unsure how to budget effectively.

Strengthen Your Business While Reducing Debt

You can better your business while reducing your debt. Know how to budget, possibly expand your business, and better your marketing skills.

Essential Home Office Supplies has ideas for the best office furniture, the best office tech supplies, and every other essential office supply you might need to make your home office comfortable and functional.